Kreischer Miller recently held its annual investment industry update, which covered a host of topics including the latest updates on GIPS, the SEC Marketing Rule, fair value guidance, taxes, and compliance, as well as a discussion on valuation drivers in an investment firm.

Todd Crouthamel and Craig Evans, Directors in Kreischer Miller’s Investment Industry Group, provided an update on Fair Value Guidance: ASU 2022-03 Fair Value Measurements of Equity Securities Subject to Contractual Sale Restrictions.

In June 2022, The Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU) with guidance on the fair value of equity securities subject to contractual sale restrictions (ASU-2022-03). This update was released by the FASB to clarify the guidance in ASC 820, Fair Value Measurement, rather than change any of its contents.

The ASU affects all companies that have investments in equity securities measured at fair value and subject to a contractual sale restriction. A contractual restriction is any restriction imposed on a specific holder (e.g., a lock-up agreement), rather than a regulatory or legal restriction that is a natural characteristic of the equity security itself.

Before this ASU, topic 820 did not specifically detail these two restrictions nor state whether to apply a discount to the fair value of the restricted equity securities. With the update, the FASB has provided clarification and states that contractual restrictions should not be considered when measuring the security’s fair value; on the other hand, any regulatory or legal restrictions should be considered when measuring the security’s fair value.

Applying the Update: Effective Date and Transition

The FASB states that this update only applies to securities acquired, executed, or modified after the date of adoption for any investment company, i.e., 946 entities – public and non-public. Therefore, if an investment company already holds a security with either contractual or legal restriction, the original valuation method used should remain unchanged. All other entities should apply the changes prospectively and recognize any adjustments from the adoption in earnings with a disclosure on the date of adoption.

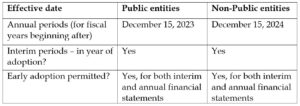

The effective date of the update is as follows:

The update also requires additional disclosure for equity securities subject to contractual sale restrictions, including:

- The fair value of equity securities to contractual sale restrictions reflected in the balance sheet

- The nature and remaining duration of the restriction(s)

- The circumstances that could cause a lapse in the restriction(s)

If you’d like to view the video of this discussion or any of the other presentations from our annual investment industry update, click here.

If you have any questions about this information or would like to discuss your firm’s needs, please contact Kreischer Miller’s Investment Industry Group.