The CFA Institute’s release of the Guidance Statement for OCIO Portfolios marks a pivotal moment for firms managing outsourced chief investment officer (OCIO) mandates. This is a timely and necessary evolution—one that brings clarity, structure, and comparability to a rapidly growing segment of the investment industry.

This article distills the key elements of the guidance into an accessible summary tailored for investment performance professionals.

What Is an OCIO Portfolio?

At its core, an OCIO portfolio is a pool of assets managed by a firm that provides both strategic investment advice and investment management services. These portfolios are typically governed by an investment mandate approved by the asset owner or oversight body and span multiple asset classes. The OCIO acts as a fiduciary, responsible for providing strategic investment advice and investment management services in alignment with the client’s objectives.

Importantly, the guidance statement clarifies that both advisory and management roles must be present for a portfolio to qualify under the OCIO definition.

When the Guidance Applies (and When It Doesn’t)

The guidance statement provides helpful examples to determine applicability. For instance:

- Applicable: A firm advising on strategic investment advice and managing all asset classes in a foundation’s portfolio.

- Not Applicable: A firm managing only the equity sleeve of a broader mandate or providing only strategic investment advice without managing the investments.

Retail client portfolios and UK fiduciary management providers are excluded, with the latter governed by separate GIPS standards for FMPs.

Required OCIO Composites: A New Framework for Comparability

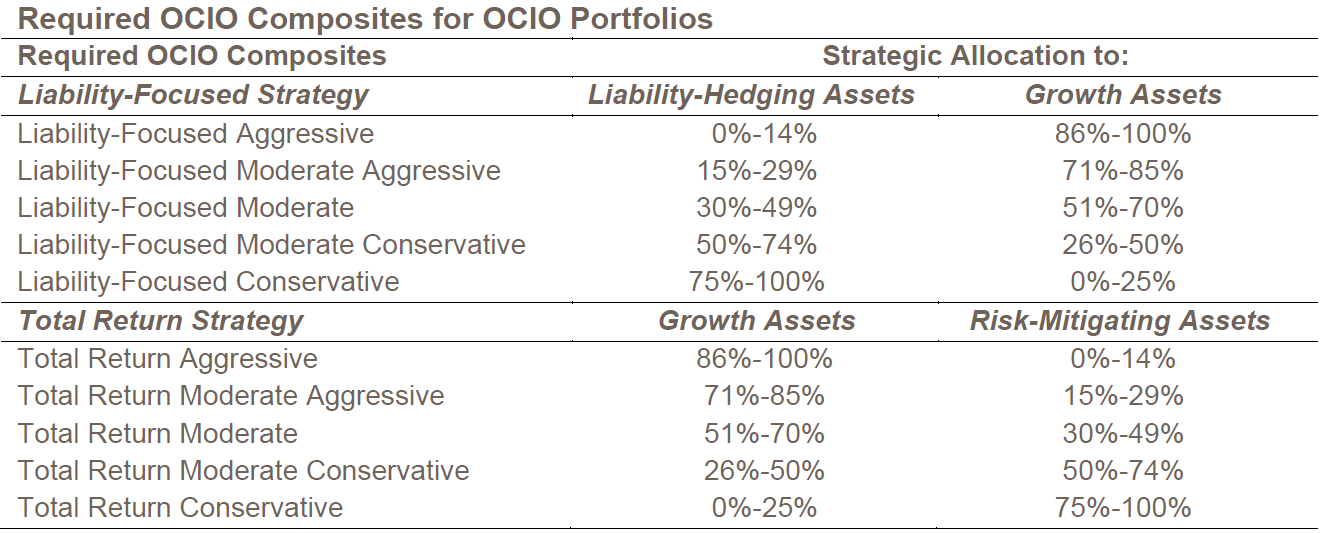

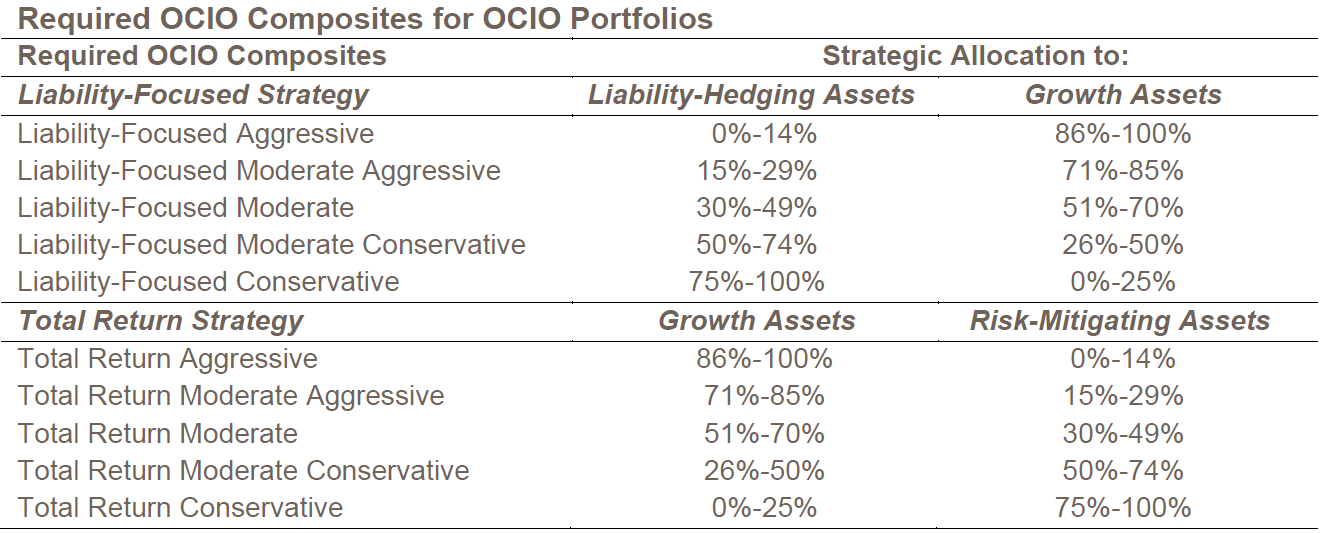

One of the most impactful elements of the guidance is the requirement to create standardized OCIO composites. These composites are based on strategic asset allocation—not client type—and fall into two categories:

- Liability-Focused Strategies: Consist of OCIO Portfolios managed with an objective to meet a liability stream, which may be contractually prescribed. Examples include corporate pension funds and insurance portfolios.

- Total Return Strategies: Consist of OCIO Portfolios managed with a primary focus on capital appreciation with no liability matching. Examples include endowment, foundation, operating reserve, and family office portfolios.

Each category includes five composite types based on allocation ranges. This structure enables apples-to-apples comparisons across firms, a long-standing challenge in the OCIO space. The required OCIO composite structure is as follows:

Asset Classification and Disclosure

The guidance requires OCIOs to classify assets as either liability-hedging/risk-mitigating or growth, depending on the strategy. The guidance statement provides the following recommended classifications:

- Investment-grade fixed income and cash = liability-hedging/risk-mitigating

- Hedge funds = may be classified based on strategy

- All other assets = growth

Firms must disclose their classification methodology and apply it consistently. This transparency is critical for consultants (and verifiers) assessing performance integrity.

Legacy Assets and Discretion

Legacy assets—those inherited from prior managers pose a challenge with regard to discretion. The guidance offers three options:

- Include portfolios with legacy assets if the firm can still manage its intended strategy.

- Include only the non-legacy portion.

- Exclude portfolios with material legacy assets entirely.

Whatever the approach, firms must disclose their policy and apply it consistently.

Benchmark Considerations

The guidance statement addresses benchmarks, including commonly used benchmarks in the OCIO space such as blended and portfolio weighted custom benchmarks.

Required Returns

OCIO reports for required OCIO composites must present gross and net time-weighted returns. OCIO firms must also disclose the current fee schedule, including all types of fees earned (such as management fees for the OCIO portfolio and fees from proprietary funds). This allows users of the reports to understand the total economic picture.

Required Additional Disclosures

- For liability-focused composites, firms must present the percentages of composite assets represented by liability-hedging assets and growth assets

- For total return composites, firms must present the percentage of composite assets represented by growth assets and risk-mitigating assets

- Firms must also present the percentage of composite assets represented by private market investments and hedge funds

Distribution and Reporting

Firms must make every reasonable effort to provide the relevant Required OCIO Composite’s GIPS Report to all OCIO Portfolio prospective clients. This does not preclude firms from providing additional GIPS Reports to prospective clients.

Why This Guidance Is Important

For asset owners and consultants, the guidance enhances comparability and trust. For OCIO firms, it provides a roadmap to demonstrate integrity and professionalism.

In short, it’s about leveling the playing field. Before this guidance, performance reporting has been riddled with inconsistent definitions and opaque disclosures.

As OCIO services continue to expand, firms that embrace these standards will be better positioned to:

- Respond to RFPs with confidence

- Report to consultant databases with clarity

- Demonstrate fiduciary rigor and transparency

Call to Action

The OCIO model is here to stay. The GIPS Guidance Statement for OCIO Portfolios isn’t just a technical document—it’s a blueprint for trust. By embracing these standards, firms can differentiate themselves, consultants can deliver greater value, and asset owners can invest with confidence. The Guidance Statement is effective December 31, 2025.

If your firm manages OCIO portfolios—or is considering entering the space—now is the time to act:

- Review your composite structure and asset classification policies.

- Update your GIPS reports to reflect the new composite requirements.

- Engage with your verifier to ensure your approach aligns with the guidance.

- Educate your team and clients on what the changes mean and how they benefit stakeholders.

Ready to lead the way? Start today. Compliance isn’t just good governance—it’s good business.

Thomas A. Peters can be reached at tpeters@kmco.com or 215.441.4600.

underlying risks is helpful. There are two main types of risk that investors need to assess: investment risk and operational risk.

underlying risks is helpful. There are two main types of risk that investors need to assess: investment risk and operational risk.