On February 15, 2023 the U.S. Securities and Exchange Commission (SEC) proposed new rules and amendments to the Investment Advisors Act of 1940 directed at the current Custody Rule and designed to address how investment advisors safeguard client assets.

First and foremost, the Custody Rule as we know it under 206(4)-2 would be redesignated as a new rule, the Safeguarding Rule, under 223-1. From there, several amendments are being proposed to enhance investor protections. Corresponding amendments are also being proposed to the Recordkeeping Rule (204-2) and new amendments are being proposed to Form ADV.

The proposals are designed to modernize the scope of assets and activities that would initiate application of the rule, including discretionary authority to trade within the definition of custody. Additionally, the proposals further define what it means for qualified custodians to have possession or control and adds a requirement that an advisor enter into a written agreement with and receive certain assurances from qualified custodians. Further, the proposals offer several changes surrounding the privately offered securities exception. Next, the proposals go on to add provisions regarding segregation of client assets. Finally, the proposals offer some changes to the surprise examination requirements.

Each of the areas is discussed in more detail below.

Proposals Impacting the Scope of Assets and Activities

Scope of Rule

The proposed rule would change the current rule’s scope in two key aspects:

- The proposed rule would expand the current rule’s coverage beyond “funds and securities” to “client assets”

- “Assets” would be defined as “funds, securities, or other positions held in a client’s account”

- The proposed rule makes explicit that custody includes discretionary authority

Takeaways

The proposed rule takes an expansive approach to the types of assets subject to the rule and is designed to remain ageless, encompassing new investment types as they continue to evolve and expand. The types of investments that may not have necessarily been included under the current rule that would now be subject to the Safeguarding Rule include, but are not limited to: short positions; written options; all crypto assets (even in instances where such assets are neither funds nor securities); financial contracts held for investment purposes; collateral posted in connection with a swap contract on behalf of the client; and physical assets, including but not limited to artwork, real estate, precious metals, or physical commodities (e.g. wheat or lumber).

Interestingly, the proposed rule goes on to indicate that the meaning of assets would also encompass investments that would be accounted for in the liabilities section of a balance sheet or represented as a financial obligation of the client. The SEC indicated it believes that the entirety of a client account’s positions, holdings, or investments should receive the protections of the proposed rule.

The proposed rule generally preserves the current rule’s definition of custody (i.e., possession of client funds or securities); however, one important clarification has been added – discretionary trading authority is an arrangement that triggers the rule. This is a major change from the prior rule because in connection with the current Custody Rule, the SEC stated that an advisor’s authority to issue instructions to a broker-dealer or a custodian to effect or to settle trades, or authorized trading, does not constitute custody.

There is some good news, though. If this discretionary authority (i.e., instructing the client’s qualified custodian to transact in assets that settle only on a delivery versus payment (DVP) basis) is the sole reason that an advisor is subject to the rule, then the advisor would be exempt from the surprise examination requirements. This is similar to the current exemption when the sole basis is automatic fee deduction. This and other exceptions are discussed in more detail in the “Exceptions from the Surprise Examination Requirement” section below.

Proposals Surrounding Qualified Custodians

Investment advisors with custody of client assets would still be required to maintain those assets with a qualified custodian, but the proposed rule adds several ways to strengthen that requirement.

Definition of Qualified Custodian

- The proposed rule requires banks and savings associations that act as qualified custodians to utilize accounts that are distinguishable from a general deposit accoun

- The proposed rule also requires banks and savings associations to clarify the nature of the relationship between the account holder and the qualified custodian as a relationship account that protects client assets from creditors of the bank or savings association in the event of insolvency or failure

- Foreign Financial Institutions (FFIs) that act as qualified custodians must meet seven new conditions under the proposed rule to serve as a qualified custodian. They must:

- Be incorporated or organized under the laws of a country or jurisdiction other than the United States, provided that the advisor and the SEC are able to enforce judgments

- Be regulated by a foreign country’s government, an agency of a foreign country’s government, or a foreign financial regulatory authority as a banking institution, trust company, or other financial institution that holds financial assets for its customers

- Be required by law to comply with anti-money laundering and related provisions

- Hold financial assets for customers in an account designed to protect such assets from creditors of the FFI in the event of insolvency or failure

- Have the financial strength to provide due care for client assets

- Be required by law to implement practices, procedures, and internal controls designed to ensure the exercise of due care with respect to the safekeeping of client assets

- Not be operated for the purpose of evading the provisions of the proposed rule

Takeaways

The proposed rule, like the current rule, continues to define the term “qualified custodian” to mean a bank or savings association, registered broker-dealer, registered futures merchant, or certain types of foreign financial institutions. Except for the changes above, the types of institutions that may serve as qualified custodians are not being changed. The SEC believes the change for banks and savings associations will improve the safeguarding of client assets by creating a fiduciary relationship rather than a debtor-creditor relationship.

The new requirements for FFIs are partly drawn from the SEC’s experience with the factors relevant to the safekeeping of foreign assets by the types of foreign entities that can act as eligible foreign custodians as defined in rule 17f-5 under the Investment Company Act. The SEC believes these requirements would help promote an FFI having generally similar protections as a U.S.-based qualified custodian.

Possession or Control

- The proposed rule would require the qualified custodian to have “possession or control” of client assets. Possession or control is defined as:

- Holding assets such that the qualified custodian is required to participate in any change in beneficial ownership of those assets

- The qualified custodian’s participation would effectuate the transaction involved in the change in beneficial ownership

- The qualified custodian’s involvement is a condition precedent to the change in beneficial ownership

Takeaways

This is a crucial change from the current rule. The SEC has made it clear in the proposal that “accommodation reporting” does not constitute participation. Additionally, this could have far reaching aspects as it relates to crypto assets. Crypto asset trading volume often occurs on crypto asset trading platforms that directly settle the trades placed on their platforms. Due to the direct settlement, investors must pre-fund trades, whereby the investors transfer their crypto assets to the exchange prior to the execution of any trade. Since those trading platforms are generally not qualified custodians, and given the expanded definition of assets under the proposed rule, this practice would result in an advisor with custody of a crypto asset being in violation of the proposed rule, since the asset would not be maintained by a qualified custodian from the time the crypto asset security was moved to the trading platform through the settlement of the trade.

Minimum Custodial Protections

- The written agreement between the advisor and custodian (or the advisor and the client if the advisor serves as the qualified custodian) must contain the following contractual terms:

- Requirement that the qualified custodian respond promptly to records requests from the SEC or independent public accountants engaged by an advisor for the purposes of complying with the proposed rule

- Specification of the advisor’s agreed-upon level of authority to effect transactions in an account

- Requirement that the qualified custodian deliver account statements to clients and to the advisor

- Provision prohibiting the qualified custodian from identifying assets on account statements for which the qualified custodian lacks possession or control (i.e., accommodation reporting) unless requested by the client and, if so requested, must be clearly labeled as such

- Requirement that the qualified custodian obtain a written internal control report that includes an opinion of an independent public accountant regarding the adequacy of the qualified custodian’s controls

- The proposed rule requires advisors to obtain reasonable assurances from a qualified custodian that include the following:

- They will exercise due care

- They will indemnify the client against losses caused by the qualified custodian’s negligence, recklessness, or willful misconduct

- They will not be excused from obligations to the client as a result of any sub-custodial or other similar arrangements

- They will clearly identify and segregate client assets from their own assets and liabilities

- They will not subject client assets to any right, charge, security interest, lien, or claim in favor of the qualified custodian or its related person or creditors, except to the extent agreed to or authorized in writing by the client

Takeaways

Under existing market practices, advisors are generally not a party to the custodial agreement. Thus, the requirement for an advisor to enter into a written agreement with a qualified custodian will be a significant industry change. The good news is that it may alleviate certain concerns around inadvertent custody since the agreement will clearly define the advisor’s level of authority.

The proposed rules may also have a significant impact on custodians in terms of cost to provide these assurances and to satisfy these additional requests if they are not already providing them. For example, the change in the level of indemnification may create added insurance costs. Additionally, if a custodian is not currently receiving an internal control report, that may also add to the cost of compliance. The internal control requirement is not new, it was just previously only applicable when the advisor or one of its related persons served as a qualified custodian. This proposal expands that internal control requirement to all qualified custodians. Furthermore, in a change from the current rule which only requires statements be provided to clients, qualified custodians would now also be required to provide them to the advisor.

Proposals Affecting Privately Offered Securities (i.e., certain assets that are unable to be maintained with a qualified custodian)

The increased scope of the proposed rule to include all client assets (e.g., gold) required amendments to the privately offered securities aspects of the current rule. Additionally, the expansion of the amount and types of privately offered securities (e.g., private pooled investment vehicles) was cause for concern to the SEC. As such, the proposed rule is seeking to make changes in the following areas:

Privately Offered Securities Exception

- The proposed rule would provide an exception to the requirement to maintain client assets with a qualified custodian where an advisor has custody of privately offered securities or physical assets, provided it meets the following conditions:

- The advisor reasonably determines and documents in writing that ownership cannot be recorded and maintained (book-entry, digital, or otherwise) in a manner in which a qualified custodian can maintain possession, or control transfers of beneficial ownership, of such assets

- The advisor reasonably safeguards the assets from loss, theft, misuse, misappropriation, or the advisor’s financial reserves, including the advisor’s insolvency

- An independent public accountant, pursuant to a written agreement between the advisor and the accountant:

- Verifies any purchase, sale, or other transfer of beneficial ownership of such assets promptly upon receiving notice from the advisor of any purchase, sale, or other transfer of beneficial ownership of such assets

- Notifies the Commission within one business day upon finding any material discrepancies during the course of performing its procedures

- The advisor notifies the independent public accountant engaged to perform the verification of any purchase, sale, or other transfer of beneficial ownership of such assets within one business day

- The existence and ownership of each of the client’s privately offered securities or physical assets that is not maintained with a qualified custodian are verified during the annual surprise examination or as part of a financial statement audit

Takeaways

These changes represent a significant departure from the current rule and put an added burden on advisors. This is particularly evident in that advisors will now need to have processes in place to provide notice to their independent public accountant within 24 hours of essentially any change to a privately offered security or physical asset. The independent public accountant would then have a record built to compare against during the annual surprise examination.

Think of it like this: the independent public accountant could theoretically see a transaction during the annual surprise examination that wasn’t reported to them within 24 hours of the date of the transaction. Then they themselves would have 24 hours from seeing that discrepancy to report the advisor for the material discrepancy of not reporting the transaction to the independent public accountant within 24 hours. Additionally, because of the increased scope, regardless of the exception, many physical assets that aren’t “audited” will still need to be verified during the annual surprise examination.

Definition of Privately Offered Securities and Physical Assets

- The proposed rule retains the elements of the current rule’s description that requires the securities to be acquired from the issuer in a transaction not involving any public offering

- The proposed rule retains the element of the current rule’s description that requires the securities to be transferable only with the prior consent of the issuer or holders

- The proposed rule also requires the securities to be uncertificated and recorded only on the books of the issuer or its transfer agent in the name of the client, with one key distinction:

- The proposed rule would require that the securities be capable of only being recorded on the non-public books of the issuer or its transfer agent

- The SEC is not providing a definition of physical asset because it believes it to be self-evident

Takeaways

The tweak of the definition to require securities to be capable of only being recorded on the issuer’s non-public books will have an impact on crypto assets. Since such assets are often issued on public blockchains, they would not satisfy the conditions of privately offered securities under the proposed rule. Additionally, because the SEC chose not to define physical assets, it leaves some ambiguity in the rule. The SEC provided some examples:

- Real estate and physical commodities such as corn, oil, and lumber are physical assets

- Cash, stocks, bonds, options, futures, and funds are not (even if they provide exposure to physical assets)

- Physical ownership of non-physical assets (e.g., stock certificates, private keys, bearer and registered instruments) do not themselves qualify as physical assets

- Warehouse receipts for certain commodities would not qualify for the exception even though the commodities documented by the warehouse receipt may

- A deed for real estate would not qualify for the exception, but the physical buildings or land would qualify

Proposals Surrounding Segregation of Client Assets

Segregation of Client Assets

Advisors must attain reasonable assurance of segregation of client assets at a qualified custodian, but when an advisor has custody, the proposed rule would require such assets:

- Be titled or registered in the client’s name or otherwise held for the benefit of that client

- Not be commingled with the advisor’s assets or its related persons’ assets

- Not be subject to any right, charge, security interest, lien, or claim of any kind in favor of the advisor, its related persons, or its creditors, except to the extent agreed to or authorized in writing by the client

Takeaways

The SEC’s goals are to extend current custodial requirements to advisors who act as qualified custodians. In practice, most advisors who act as qualified custodians already have procedures in place to meet these requirements and the proposed changes should just serve as added clarity within the proposed rule. The SEC’s goal is not to prohibit operational practices that satisfy the requirements and not to prohibit client authorized actions (e.g., securities lending) that have been agreed to in writing.

Proposals Impacting the Surprise Examination Requirement

The proposed rule would expand the availability of the current rule’s audit provision, which should provide certain exceptions from the surprise examination as well as certain other exceptions:

Scope of the Audit Provision

Elements of the proposed rule’s audit provision are largely unchanged from the audit provision of the current rule, apart from the following:

- The proposed rule expands the availability from just limited partnerships, limited liability companies, and pooled investment vehicles to also include “any other entity”

- The proposed rule would require the financial statements of non-U.S. clients to contain information substantially like statements prepared in accordance with U.S. GAAP and material differences with U.S. GAAP to be reconciled

- The written agreement between the advisor or the entity and the auditor would require the auditor to notify the SEC upon the auditor’s termination or issuance of a modified opinion

Takeaways

The proposed rule expands the scope of entities that can utilize the audit provision exception while also delivering the SEC some information on private funds (e.g., modified opinions) that they may not have otherwise had the ability to see or didn’t necessarily receive as timely through advisor ADV reporting through the auditor notification requirement.

Exceptions from the Surprise Examination Requirement

- As noted above in the “Scope of Rule” section, the proposed rule would contain an exception from the surprise examination requirement for client assets if the advisor’s sole basis for having custody is discretionary authority with respect to those assets

- This exception applies only for client assets that are maintained with a qualified custodian in accordance with the proposed rule

- This exception applies only for accounts where the advisor’s discretionary authority is limited to instructing its client’s qualified custodian to transact in assets that settle exclusively on a DVP basis

- Note that an advisor can rely on this exception if they also have custody for reasons that are subject to similar exceptions (e.g., sole basis is fee deduction, sole basis is related person custody, etc.)

- The proposed rule includes an exception from the surprise examination requirement if an advisor’s custody is solely because of standing letters of authorization (SLOAs)

- SLOAs would be defined as an arrangement among the advisor, the client, and the client’s qualified custodian in which the advisor is authorized, in writing, to direct the qualified custodian to transfer assets to a third-party recipient on a specified schedule from time to time

- The client’s qualified custodian cannot be an advisor’s related person

- The authorization must include:

- The client’s signature

- The third-party recipients name

- Either the third party’s address or the third party’s account number

- A notation that the advisor has no ability or authority to designate or change any information about the recipient

Takeaways

Although the exceptions have been provided for, advisors will need to carefully evaluate their discretionary authority and SLOAs so ensure they conform to the new requirements. Otherwise, they may still find themselves subject to a surprise examination.

Other Proposals and Information

Investment Advisor Delivery of Notice to Clients

The proposed rule would continue to require an advisor to notify clients in writing promptly upon opening an account with a qualified custodian on its behalf

- The proposed rule would now explicitly require the notice to include the custodial account number

Amendments to the Investment Advisor Recordkeeping Rule

The proposed rule would add the following requirements:

- Maintain copies of all written notices to clients (e.g., notice to each client upon opening accounts at qualified custodians on the client’s behalf)

- Maintain six categories of records for each client:

- Client account identification

- Custodian identification

- The basis for the advisor having custody of client assets in the account and whether a related person holds the advisor’s client assets

- This includes whether the advisor has discretionary authority with respect to any client assets in the account.

- This also includes whether the advisor has authority to deduct fees from the account

- Any account statements received or sent by the advisor, including those delivered by the qualified custodian

- Transaction and position information

- Standing letters of authorization

- Maintain copies of all documents relating to independent public accountant engagements:

- Audited financial statements

- Internal control reports

- Written agreements

Changes to Form ADV

- Item 9.A.(1) will be revised to require advisors to indicate whether they directly, or indirectly through related persons, have custody of client assets

- This includes if that custody is solely due to an advisor’s ability to deduct fees or because the advisor has discretionary authority

- Item 9.A.(2) will be revised to require the number of clients and client assets falling into each of the following categories of having custody from:

- The ability to deduct advisory fees

- Having discretionary trading authority

- Serving as general partner, managing member, trustee for clients that are private funds

- Serving as general partner, managing member, trustee for clients that are not private funds

- Having general power of attorney over client assets or check-writing authority

- Having standing letters of authorization

- Having physical possession of client assets

- Acting as a qualified custodian

- Having a related person with custody that is operationally independent

- Any other reason

- A new Item 9.B will be added to require an advisor to indicate whether it is relying on any exceptions from the proposed rule

- Advisors will be required to include more detailed information about qualified custodians utilized

- Advisors will be required to include more detailed information about accountants completing surprise examinations, financial statement auditors, or verification of client assets under the proposed rule

Existing Staff No-Action Letters and Other Staff Statements

The SEC is reviewing certain no-action letters and other staff statements to determine whether any such letters, statements, or portions thereof, should be withdrawn in connection with the adoption of the proposed rule

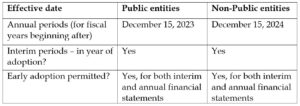

Transition Period and Compliance Date

- Advisors with more than $1 billion in regulatory assets under management (RAUM) will have 12 months from the effective date (i.e., 60 days after public in the Federal Register of a final rule) to comply

- Advisors with up to $1 billion in RAUM will have 18 months

- Advisors should continue to comply with the current rule until the required compliance date

- Advisors can adopt prior to the required compliance date but must adopt all confirming amendments including those in the corrected rules

Summary and Takeaway

This SEC proposal comes just a year after it issued several 2022 proposals surrounding private fund transparency, cybersecurity risk management, and Form PF. Across the board, the proposed changes will rewrite the Custody Rule as we know it, rename it the Safeguarding Rule, and create additional requirements.

These proposed changes continue to extend the SEC’s reach into private offerings and more modern investments such as crypto. Advisors may need to lean on internal or external compliance to ensure that policy and procedure updates capture the necessary information and to make sure the new parts of the proposed rule are covered. Qualified custodians are not off the hook either, as the proposed rule puts additional burden on them as well.

Advisors should closely monitor evolving developments to ensure operational and compliance readiness. Comments and feedback on the proposal are due 60 days after publication in the Federal Register. The SEC is seeking feedback on 280 questions contained within the proposed rule.

We would be pleased to provide further information related to this subject. For more information, contract Craig B. Evans, Director, Audit & Accounting at cevans@kmco.com.